The EURUSD pair, after pulling back from last week’s three-year high, has found support at 1.13. A new upward wave is gradually developing from this level as the medium-term uptrend remains intact. This week’s events could significantly accelerate the pair’s move toward 1.15, putting strong downward pressure on the dollar. The US currency now faces two major simultaneous challenges.

The first test comes today with the preliminary US GDP estimate for the previous quarter. According to analyst consensus forecasts, US economic growth for January-March stood at just 0.3% – the weakest performance since the second quarter of 2022. Meanwhile, the Atlanta Fed’s projections indicate negative GDP growth amid a surge in imports. Companies rushed to import goods into the US ahead of the new tariffs’ implementation, which may hurt the economy without corresponding export growth.

On Friday, traders should expect a new surge in volatility. On May 2, the US labor market report for April will be released. Expert expectations point to a slight decline in new jobs and stable unemployment, but reality may differ. This is hinted at by yesterday’s job openings data, which approached the lowest level since December 2020. Trade tensions are already having a negative impact on the labor market, contrary to the US President’s assurances about soon concluding deals with other countries.

Against this backdrop, Bank of America analysts recommend investors use any local dollar strength to open short positions. The dollar index, despite rebounding from recent lows, remains below the psychologically critical 100 level, indicating traders’ reluctance to fully recover April’s losses. Even the interest rate differential between the Fed and ECB now only limits EURUSD’s upside rather than reversing the bullish momentum.

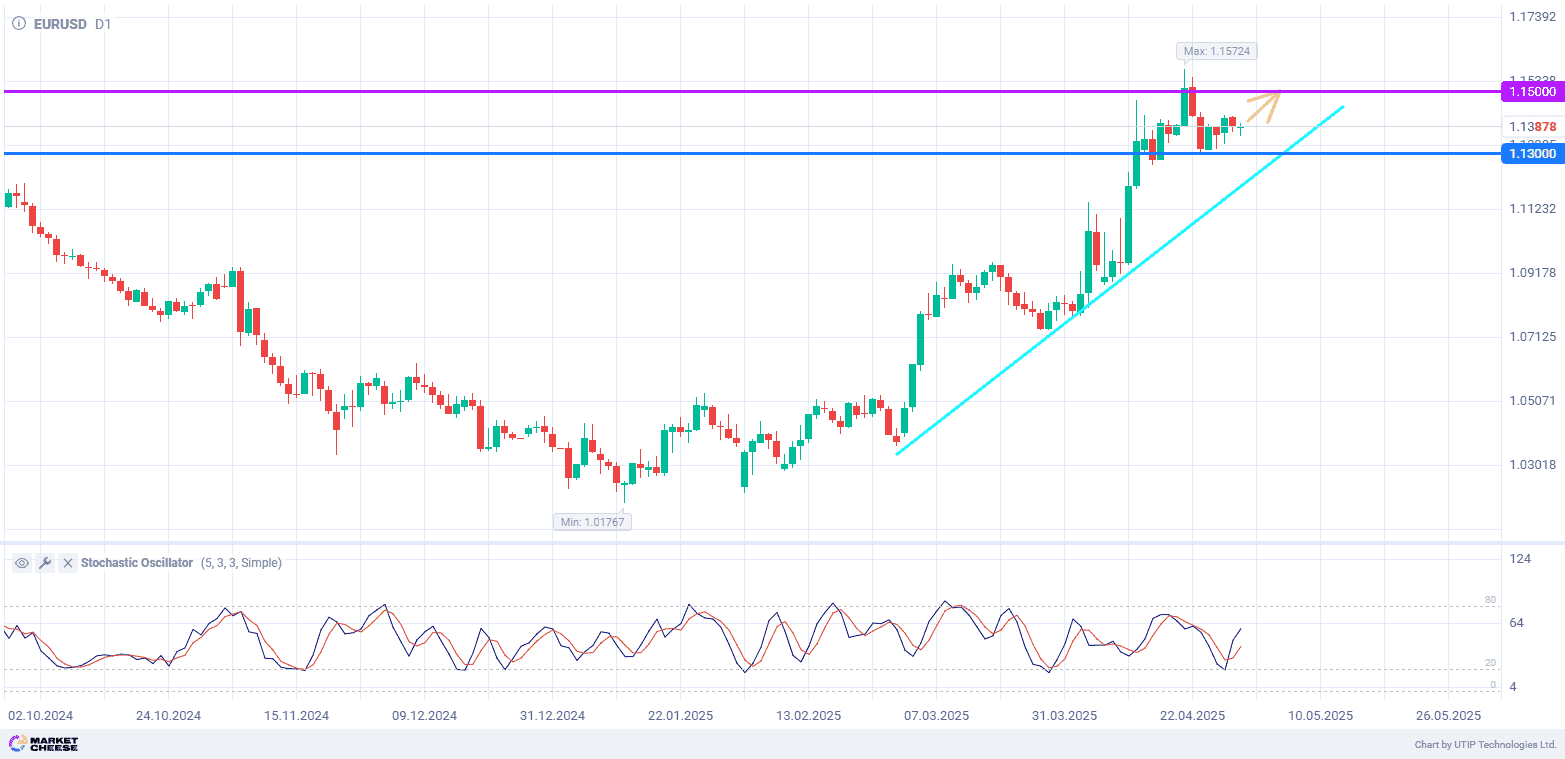

On the daily chart of EURUSD, the Stochastic indicator speaks in favor of the quotes growth continuation. The nearest target of the bulls will be to get back under their control the level of 1.15.

Consider the following trading strategy:

Buy EURUSD at the current price. Take profit – 1.15. Stop loss – 1.13.