NVIDIA shares have risen steadily since the beginning of May, gaining 9.5% from late April. On Monday, May 5, the share price reached $113.96.

The company’s shares dropped by about 19% during the first quarter of the year, underperforming the S&P 500 index. The decline was primarily driven by US export restrictions and concerns over a potential slowdown in the artificial-intelligence investment boom.

Ahead of the earnings season, Wall Street traders grew concerned that major tech companies may scale back their ambitious AI infrastructure plans after investing hundreds of billions of dollars this year. However, recent financial reports from NVIDIA’s customers, such as Microsoft and Amazon, have shown that their investments in data centers remain strong. These tech giants continue to purchase NVIDIA’s hardware for their cloud services, reinforcing confidence that demand for the company’s chips will remain robust despite strict export and supply regulations.

Previously, NVIDIA announced that it must obtain new licenses to export chips to China and some other countries, which threatened its profitability. However, to minimize the impact of US export restrictions, NVIDIA plans to upgrade its AI chips to comply with the new regulations and retain access to the Chinese market. The first samples could be available as early as June.

NVIDIA is scheduled to report its financial results for the first quarter on May 28. Investors expect the company to present solid demand for its products regardless of this year’s challenges.

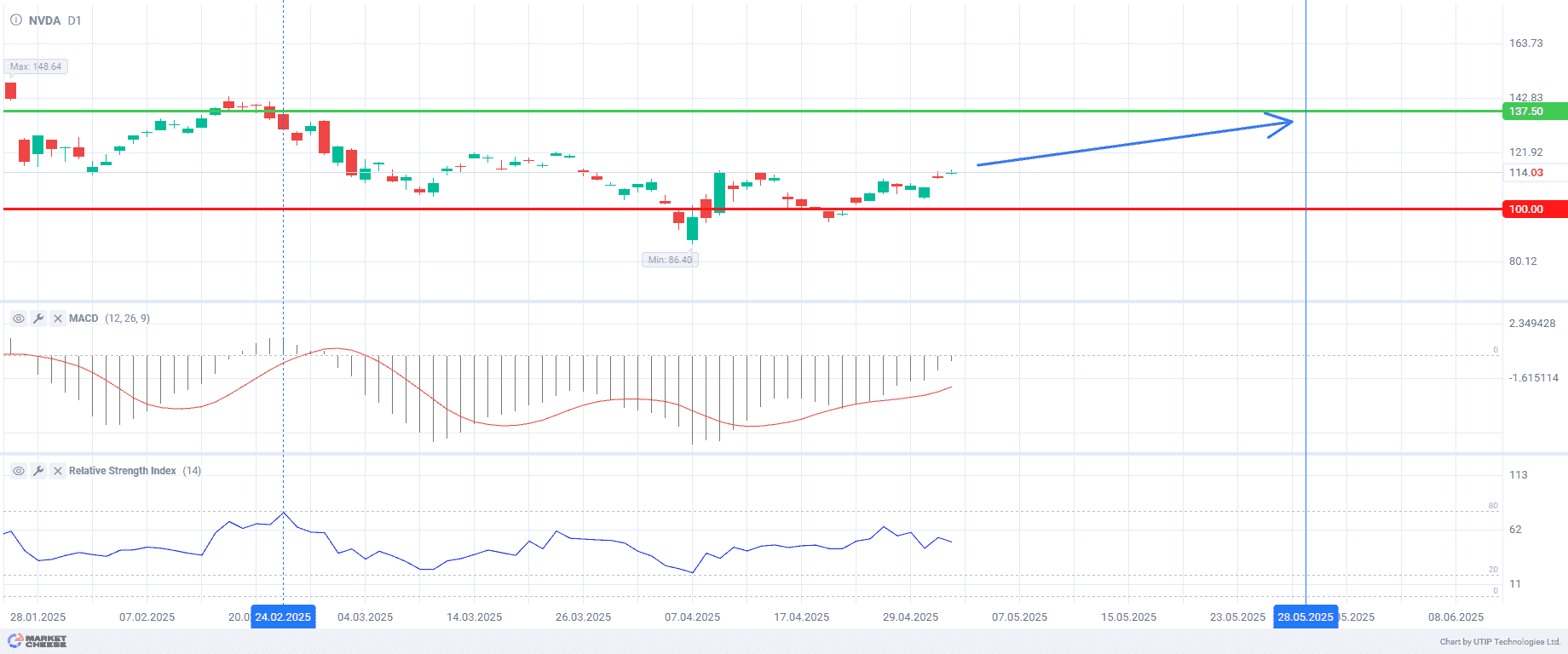

From a technical analysis perspective, the stock shows growth potential. The MACD suggests a possible change of the trend upwards, with the distance between the main and signal lines narrowing while the indicator’s values rise. Meanwhile, the RSI is in the neutral zone at 50, indicating that the stock is neither overbought nor oversold.

Current recommendation:

Buy at the current price. Take profit may be set at $137.5 per share, a key resistance level where the RSI previously entered the overbought zone. Stop loss should be set at the psychological support level of 100 to minimize risks.