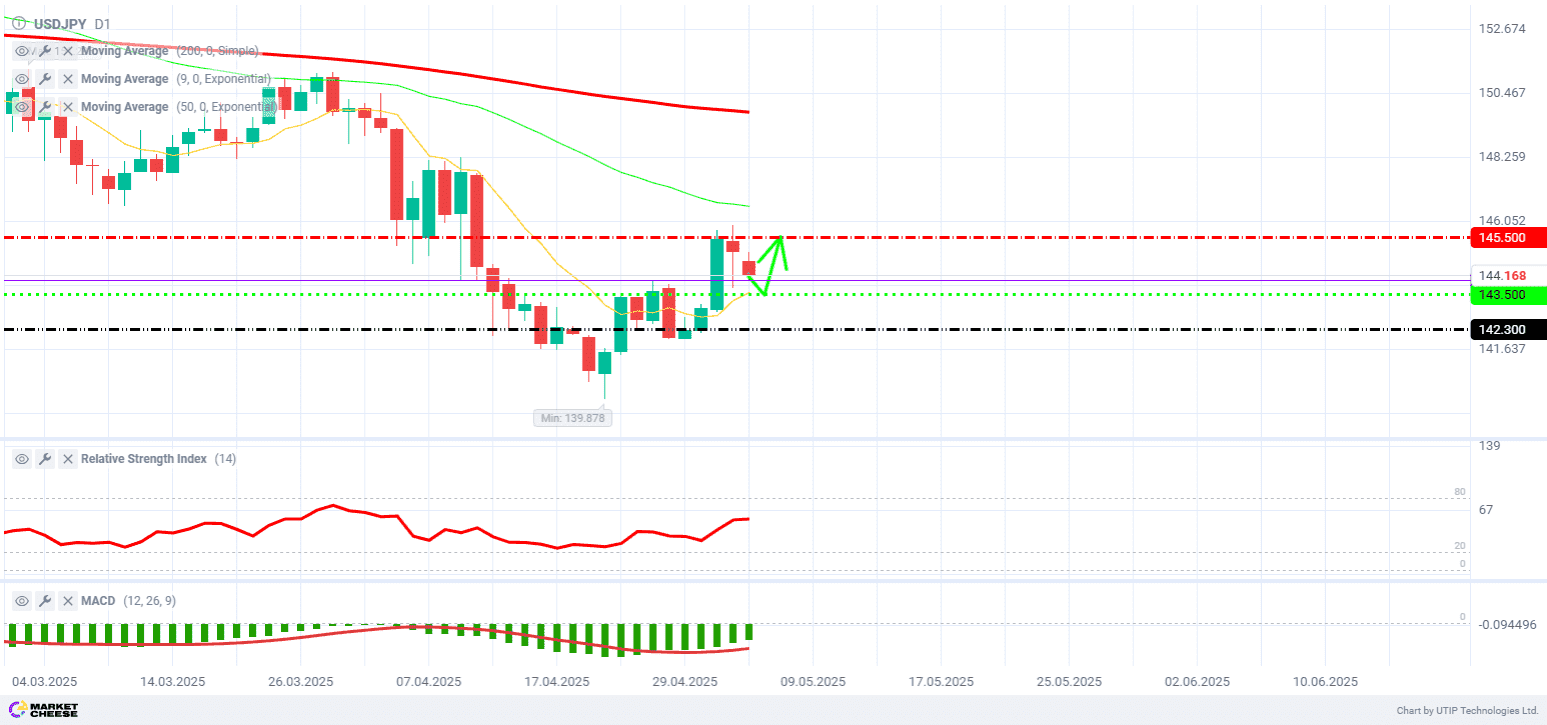

Today, on May 5, the USDJPY currency pair opened trading with a gap of 314 points below Friday’s closing price. Over the next two hours, the quotes were trying to close the gap, but failed. The price pulled back and rushed down to the support level of 144,000. A week ago, this level acted as resistance, but on Thursday, May 1, the Bank of Japan’s GDP and inflation expectations were revised downward, weakening the yen. The 144,000 level was broken, becoming support. The daily candlestick on May 2 struggled to bring the quotes back to this level by the US Non-Farm Payrolls, but closed above it again. Today the daily candlestick may re-test the support level. There is a good chance of a rebound near 144,000 and a rise to 145,500.

The Relative Strength Index (RSI) is at 56 on the daily timeframe, showing that traders’ buying sentiment is strengthening.

The Moving average convergence/divergence indicator (MACD) is below zero on the daily timeframe, but shows signs of a slow reversal, signaling a potential short-term growth of the quotes.

The United States may seek to reconnect with China and Japan on trade terms. The US dollar remains broadly supportive at the moment. Higher US Treasury bond yields and strong earnings in the tech sector contribute to this, keeping stock market sentiment positive.

BOJ Governor Kazuo Ueda emphasized that the GDP and inflation growth outlook lacks the certainty needed for further rate hikes. The central bank now expects GDP growth of just 0.5% in fiscal 2025, down from its previous forecast of 1.1%. Inflation forecast was also downgraded. Markets interpreted this position as preparations for a rate cut.

Trading strategy: pending buy limit at 143,500 with Take Profit at 145,500 and Stop Loss at 142,300.