On Tuesday, the GBPUSD pair showed growth. Despite rising at the end of the day, on Wednesday morning, the quotes rolled back from the highs reached. At the time this forecast was written, the currency pair was at 1.33432.

The British currency’s growth was due to news of a potential trade agreement between the US and the UK. Although the agreement’s details have not been disclosed, the market responded positively to the news, as it could prevent the US from imposing tariffs on British goods. The pound received additional support from the weakening US dollar, which was caused by a record deficit in the country’s trade balance in March due to a frenzy of purchases before new tariffs were introduced.

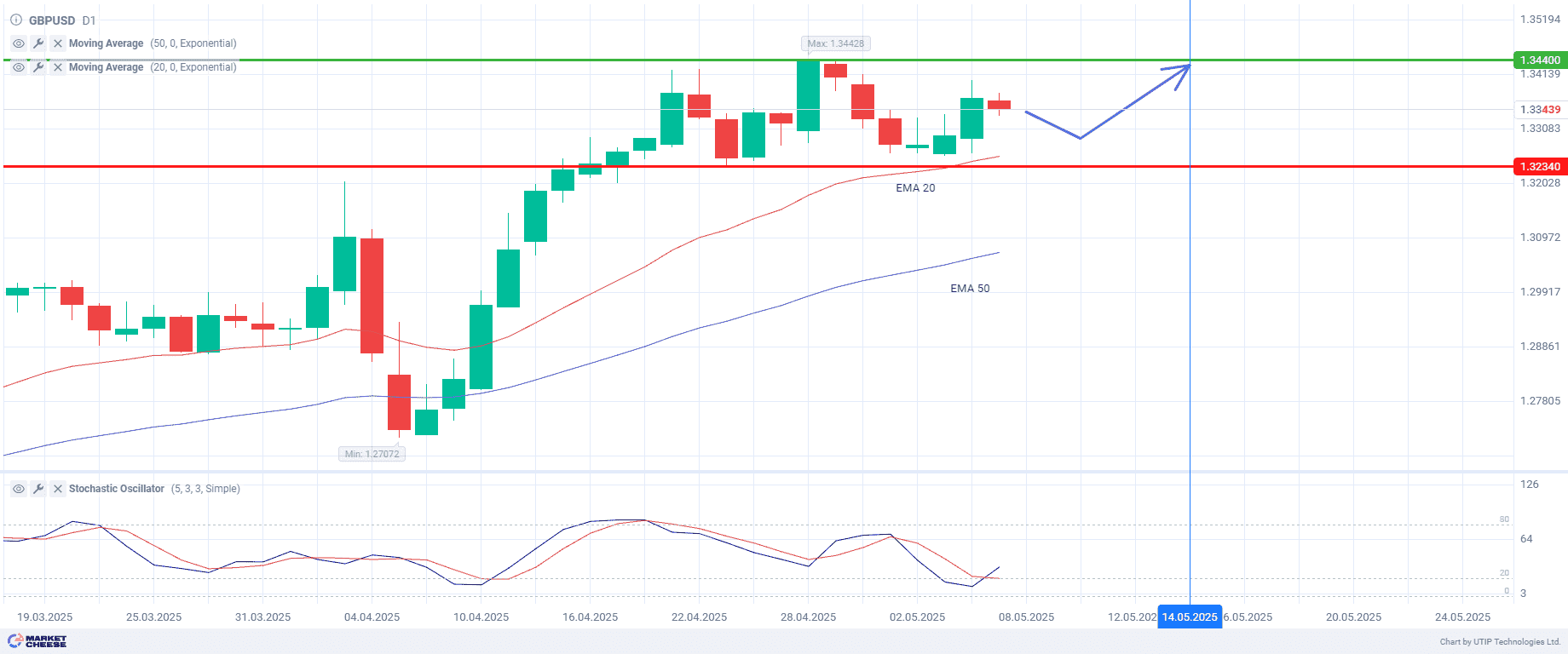

Nevertheless, the pair is still trading within the 1.3250–1.3450 range, indicating market consolidation. The situation is further complicated by ongoing uncertainty surrounding the Trump administration’s trade policies, including plans to impose 100% tariffs on foreign films and restrict imports of pharmaceutical products. This undermines the positions of both the dollar and the pound.

Investors are focusing on upcoming central bank meetings. On Wednesday, the Fed is likely to keep interest rates unchanged, but the key event will be Jerome Powell’s press conference. The market will be looking for signals about the potential start of a monetary easing cycle. The following day, the Bank of England (BoE) is expected to lower the rate by 25 basis points to 4.25%, potentially creating a monetary policy divergence between the two countries.

Analysts expect the BoE to lower its economic growth forecasts due to the impact of trade wars. The regulator may also abandon its policy of gradual easing.

GBPUSD remains well supported above the 20- and 50-day exponential moving averages (EMAs). However, further upward momentum will require significant news for traders currently stuck below 1.3400.

The Stochastic Oscillator indicates the possible formation of a new bullish momentum. %K is above %D, which could indicate an upward trend reversal. Additionally, both oscillator lines are near the oversold zone.

For now, a short-term correction after the monetary authorities’ meetings seems likely. Afterwards, the exchange rate will continue to move within the uptrend.

Current recommendation:

Buy at the current price. Set a stop loss at 1.3234, the April 23 low. Take-profit could be set at 1.344, the maximum of April 28.