The S&P 500 began Monday in negative territory, opening at 5,515.9. This follows last week’s 4.59% advance, which was fueled by improving US-China relations and better-than-anticipated corporate earnings from index companies.

Last week, Beijing exempted certain US imports from its 125% tariffs, though officials denied President Trump’s claims about new negotiations following Treasury Secretary Scott Bessent’s comments on de-escalation. These developments suggested potential improvement in relations between the world’s two largest economies, providing temporary support for the S&P 500. However, ongoing trade policy uncertainty continues to weigh on investor sentiment, contributing to increased volatility in US markets.

Meanwhile, the first-quarter report season continues in the US So far, 179 S&P 500 companies have reported results, with 73% surpassing expectations, according to LSEG data. Nevertheless, many market participants are revising their second-quarter and full-year forecasts downward amid growing concerns over escalating global trade tensions.

Despite positive developments, investors remain cautious toward the US stock market, diverting capital to international markets and thereby capping the quotes recovery.

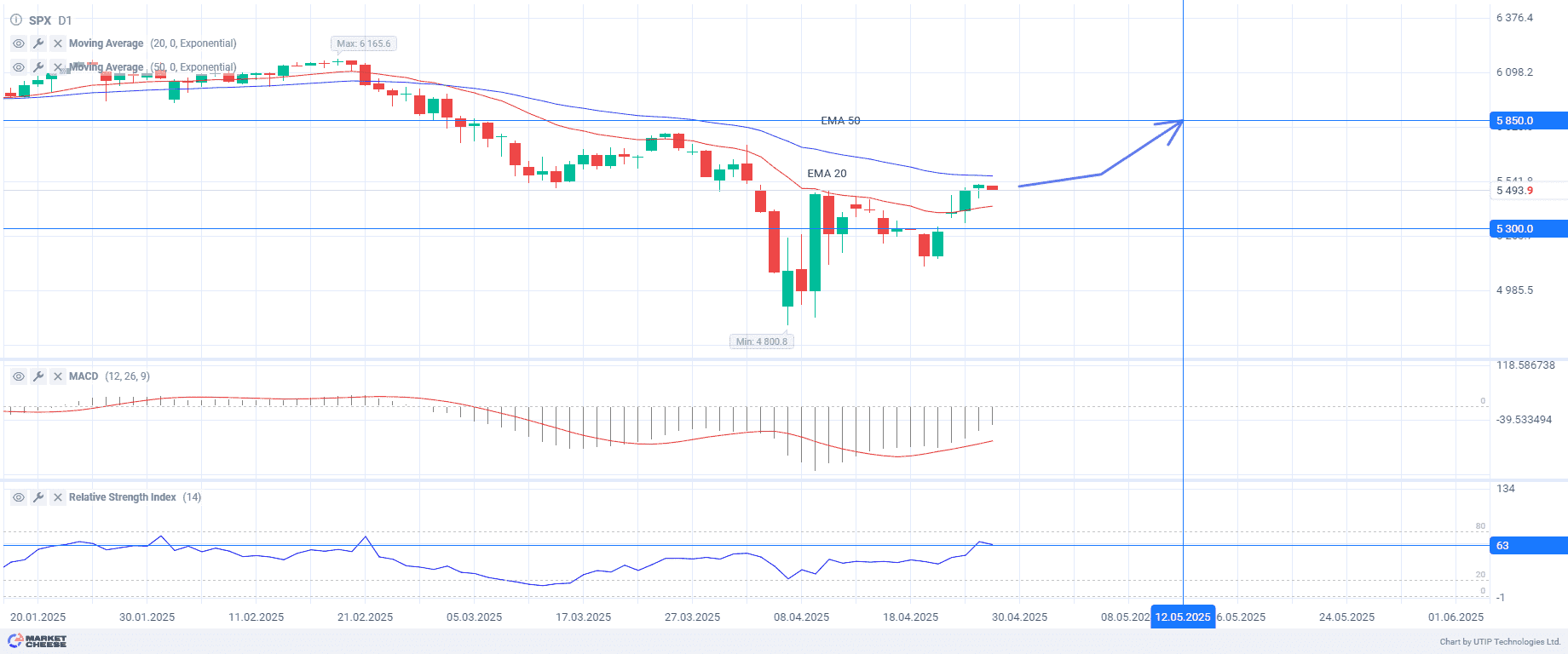

The MACD indicator shows narrowing divergence between its main and signal lines, while the RSI at 63 remains in neutral territory above the key 50 level – both signaling growing buying interest. On the daily chart, price action is consolidating between the 20-EMA and 50-EMA, characteristic of a corrective phase following the prior downtrend.

This week, over 180 companies are set to report their financial results for the first quarter, which may potentially impact market dynamics. However, the primary market driver remains developments in trade policy between the world’s largest economies.

Current recommendation:

Buy SPX at the current price as trade tensions show further signs of easing. Take profit – 5850. Stop loss – 5300.