EURUSD suffered losses on Tuesday, but retained most of its early gains. The currency pair opened at 1.14196 in Wednesday trading.

The pair’s decline was driven by the greenback strengthening on Tuesday. The US dollar surged as US Treasury secretary Scott Bessent said he believed there would be a possible de-escalation of trade tensions between the US and China. Besides, the dollar rose further after Donald Trump backed off his plan to fire Federal Reserve Chair Jerome Powell.

Yet, market participants remain cautious, given the US leader’s unpredictable actions. Despite his promises to be lenient to China when agreeing to a trade deal, Trump’s reputation as a politician who is often impulsive and erratic makes investors exercise restrain. Markets are gradually adjusting to the governing style of the president, who often makes loud statements and then changes his position without apparent consequences, which undermines the credibility of his words.

A heap of data on European Union is due for release this week, including manufacturing PMI and trade balance. They can significantly affect the euro’s direction. When it comes to the US, the unemployment rate and the consumer sentiment index from the University of Michigan will come out at the end of the working week.

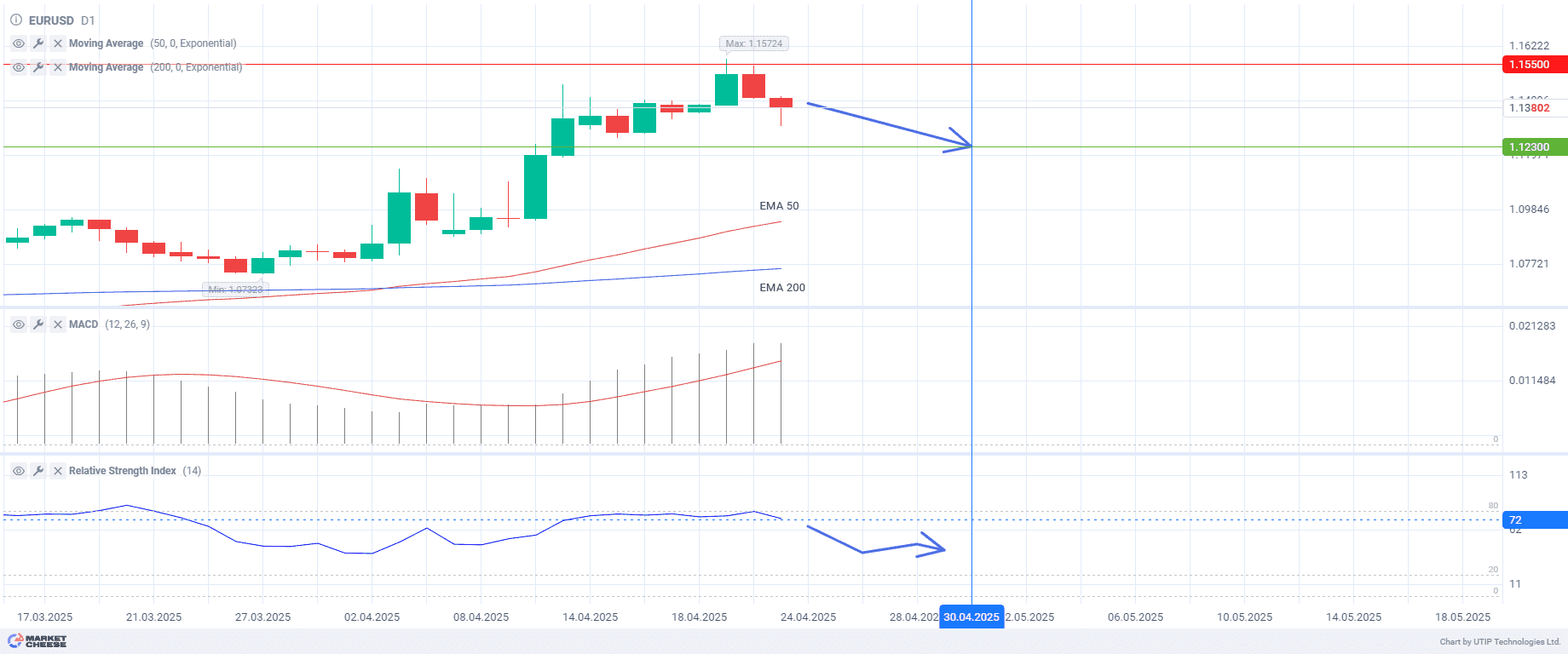

The technical analysis points to a possible correction in the nearest term. The MACD indicator has been signalling an uptrend as the divergence between the signal and main line is not decreasing and the indicator itself is in the positive zone.

At the same time, the Relative Strength Index (RSI) has reached the level of 71, which brings it closer to the overbought zone. A rebound or correction is likely in the near future.

The situation seems to be positive in long term. The price is confidently holding above the key levels of 50- and 200-day moving average, which confirms a steady uptrend. In addition, the 50-day exponential moving average (EMA) is above the 200-day EMA, which is a common positive signal.

Current recommendation:

Sell at the current price. Take profit – 1.12300. Stop loss – 1.15500.