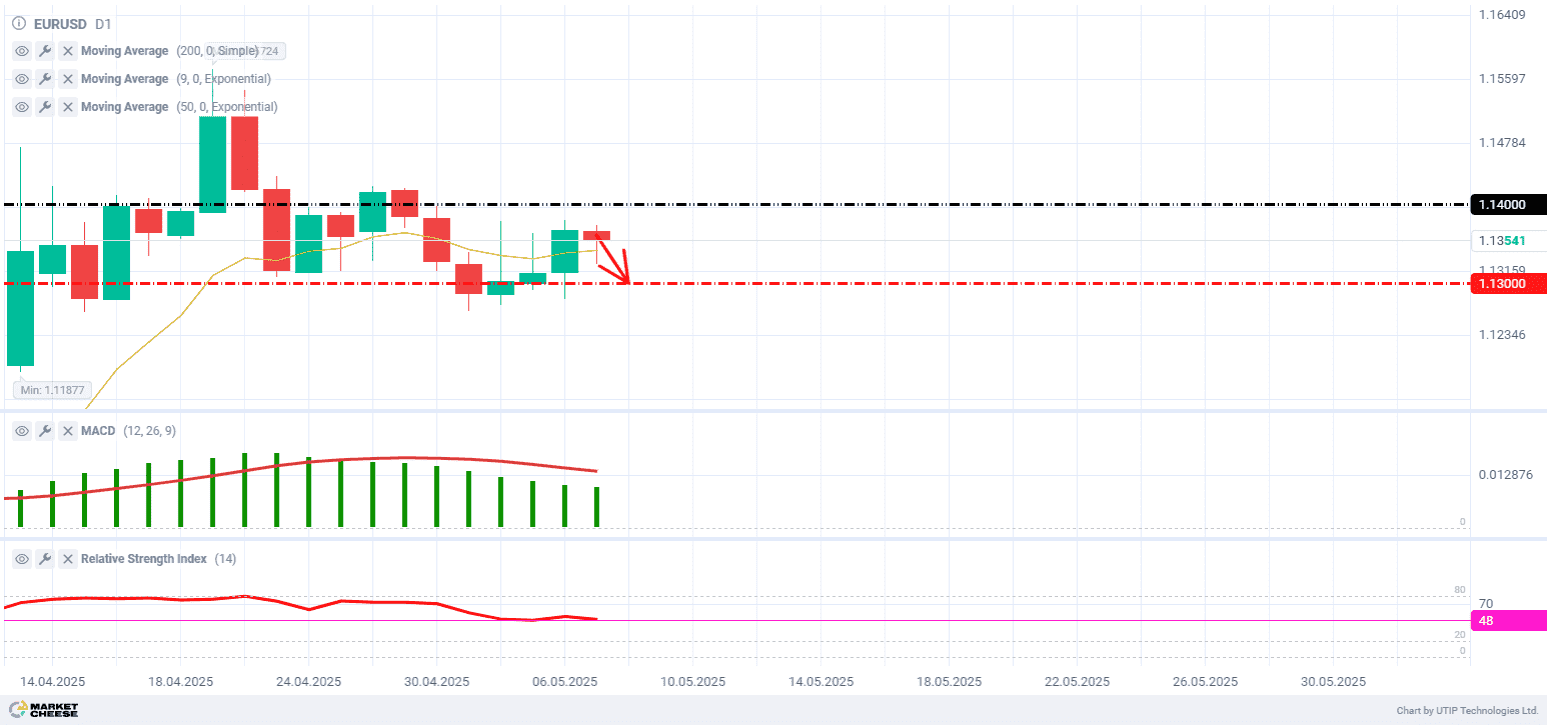

The EURUSD currency pair has been rising systematically since early February. So far, it has gained 11% (11,260 points) since February 3. The pair experienced several correction stages during this growth period. One of them is being observed right now. The quotes have entered the 1.13000–1.14200 channel since April 14. While writing this article, the pair was trading at 1.13520, in the middle of the channel.

The Moving Average Convergence/Divergence indicator (MACD) is well above the zero level on the daily timeframe, but shows systematic weakening of the growth momentum. The four-hour MACD moved to the zero line out of the negative zone and indicates a full halt in selling pressure and a shift toward buying.

Relative Strength Index (RSI) stands at 48 on the daily timeframe, down from 73 a week ago, suggesting a loss of upward momentum and a potential reversal to a downtrend. Conversely, the 4-hour RSI reflects strengthening buying activity.

The Federal Reserve (Fed) and the European Central Bank (ECB) keep moving in different directions in terms of their monetary policies. The Fed is expected to maintain rates at 4.25–4.50% today, on May 7. That said, Fed Chair Jerome Powell warned that inflation remains too high. He outlined upcoming challenges, including the possibility of new trade tariffs, which raises concerns about stagflation.

In contrast, the ECB cut rates by 25 basis points last month to 2.25%. According to officials, the central bank is set for further rate cuts. Markets are now pricing in another ECB rate cut as early as June, weighing on the euro’s outlook.

Trading Strategy: sell at the current price. Take Profit at the level of 1.13000. Stop Loss at the level of 1.14000.