Gold is declining driven by US President Donald Trump’s comments that he is not going to remove Fed Chair Jerome Powell and headlines exaggerate his statements. Trump wants Powell to lower interest rates on a faster pace.

On April 23, gold is trading at the level of $3,344 per ounce, down 0.91% from Tuesday’s close.

US Treasury secretary Scott Bessent said on Tuesday that he was monitoring the de-escalation of the tariff situation between the US and China. His statements boosted market sentiments and weighed on the price of a gold ounce.

However, Trump’s decisions on trade policies remain unpredictable, and his pressure on the Federal Reserve could still increase gold demand and push its prices further up.

Uncertain economic prospects prompt investors to seek a safe haven. The World Gold Council reports that gold ETFs registered inflows of $8.6 billion in March and a rise to $21 billion in the first calendar quarter.

Today, traders are focused on the preliminary data on manufacturing and service PMIs for Europe and the US provided by S&P Global in order to assess trading momentum. US PMIs for April will be examined for signs of a recovery in the country’s economy. The data may help change market expectations for Fed interest rate cuts this year.

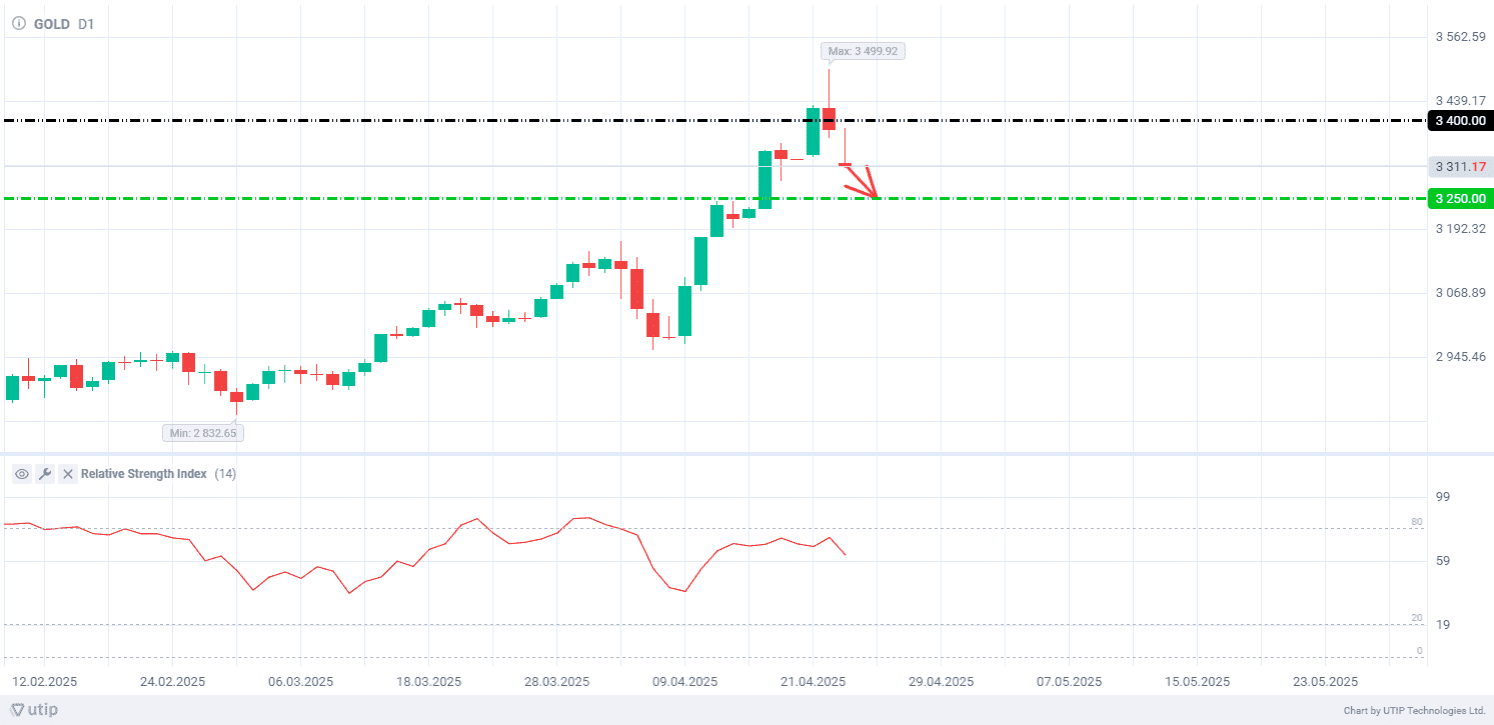

The daily Relative Strength Index (RSI) is at 67 and close to the overbought zone. The index not reaching 80 may signal a pullback in gold prices.

From a downside perspective, the current daily candle closing below 3,350 could push gold to the level of 3,300, followed by 3,250.

The following trading strategy may be suggested: selling at the current price with Take Profit at 3,250 and Stop Loss at 3,400.