On Tuesday, US natural gas prices regained some of their losses from the previous trading session. The latest decline came despite recent production cuts and expectations of higher demand later this week. Mild weather in the United States and low heating and cooling demand has allowed utilities to pump more fuel into storage, and inventories are now about 1% above the five-year average.

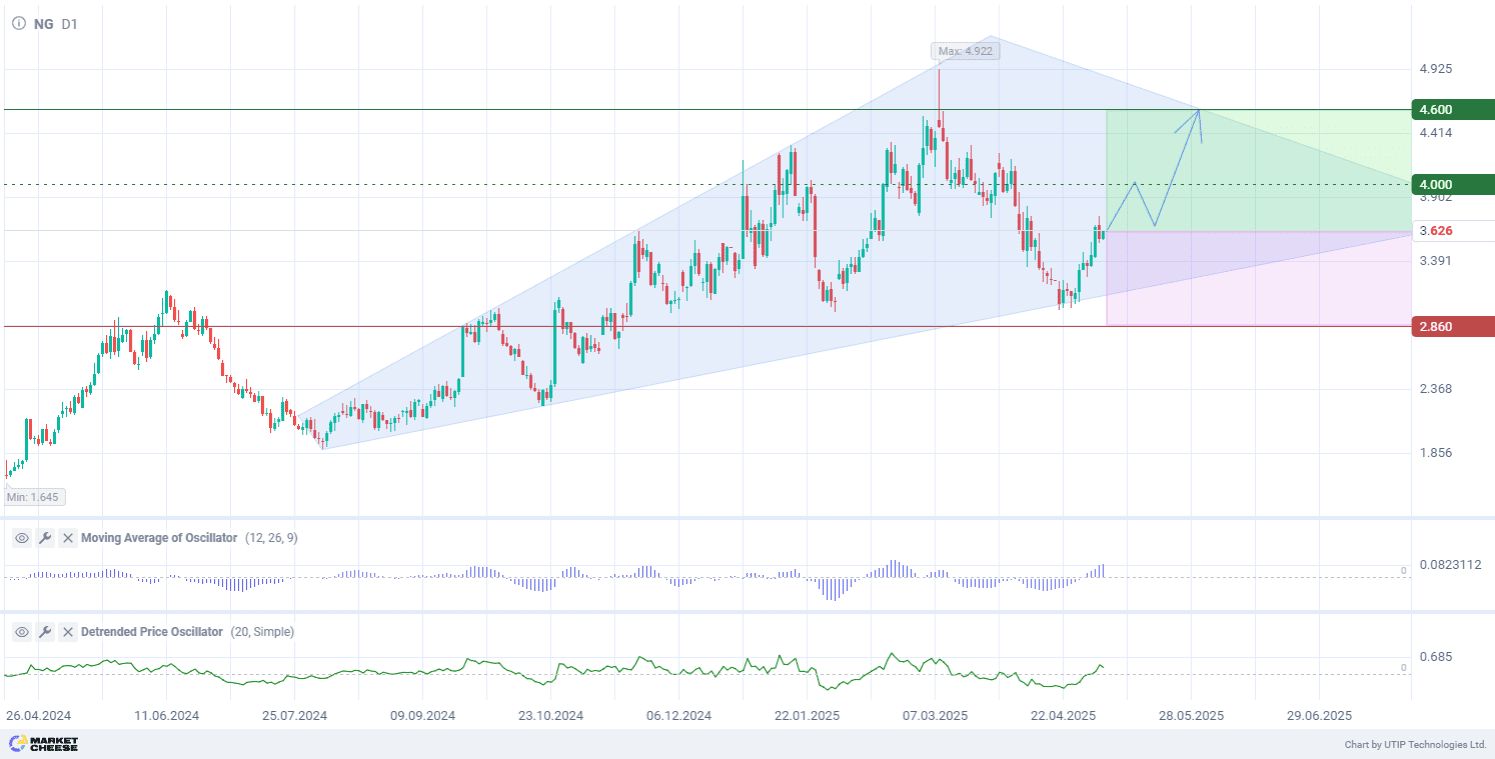

On a technical level, natural gas prices on the daily timeframe (D1) are forming the broadening wedge pattern (also known as the megaphone pattern). This formation indicates increasing volatility and a fight between the buyers and sellers. A broadening range with increasingly wide fluctuations signals rising market uncertainty, often preceding a strong directional movement.

The price is closer to the mid-range and has recently rebounded from the lower limit of the pattern.

In terms of candlestick analysis, a bullish combination has formed in the lower part of the wedge, as several candlesticks with long lower shadows indicate buying pressure. Following rising candlesticks with small bodies may reflect uncertainty in further growth, but the upward momentum persists.

The histogram of the Moving Average of Oscillator indicator has entered the positive zone, suggesting a possible shift to an uptrend.

At the same time, the Detrended Price Oscillator indicator is showing an upward reversal from the local low, being above the zero line. This confirms the strength of bullish sentiment.

While the price remains within the megaphone pattern, the upward dynamics is prioritized. However, a breakdown of the pattern’s support may provoke a new wave of decline.

Short-term prospects for natural gas prices suggest buying with the target of 4.600. Part of the profit should be taken near the level of 4.000. A Stop loss could be set at 2.860.

Since the bullish scenario is short-term, the trading volume should not exceed 2% of your total balance to reduce risks.