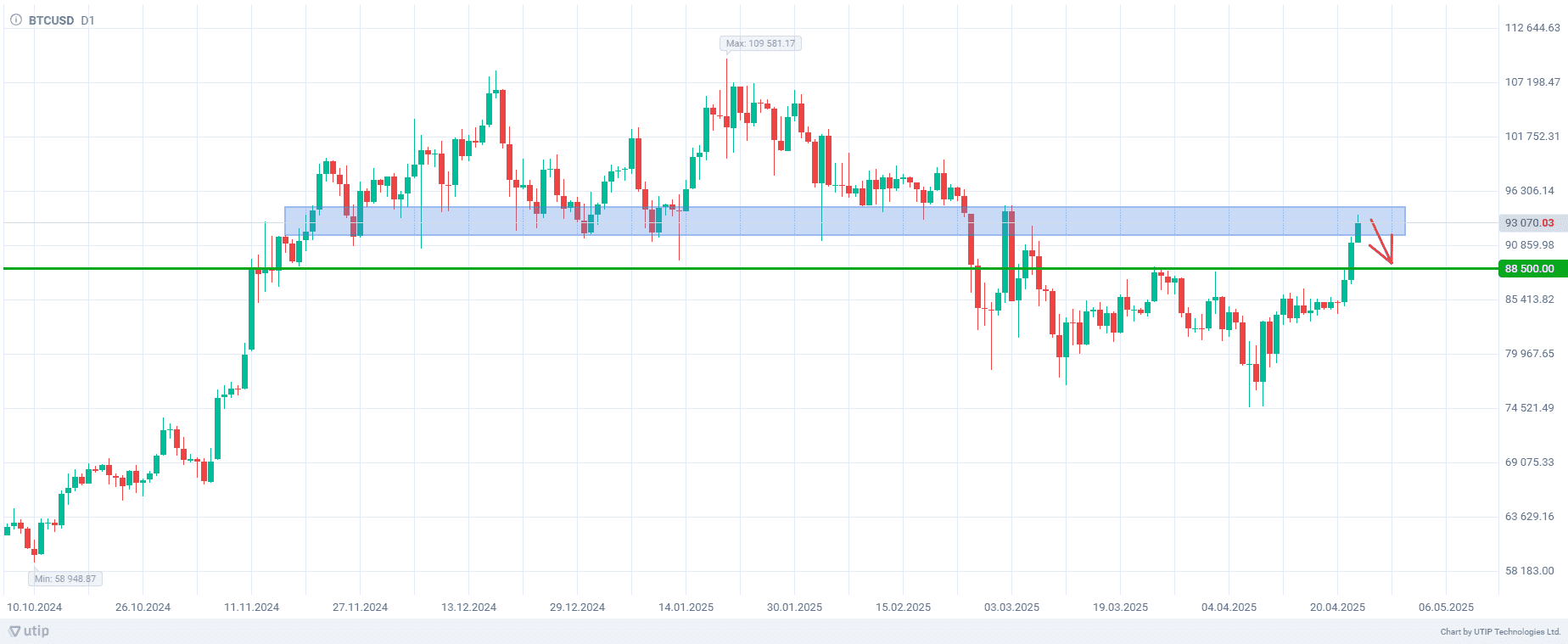

Bitcoin has likely entered the closing phase of its correction from the level of 75,000 to the price range of $91,000–95,000 per bitcoin.

The events of recent weeks point to a weak connection of cryptocurrencies to ongoing macroeconomic events and fundamentals. The assets have not played a significant role in hedging risks, like gold has. It seems as though cryptocurrencies have a life of their own, and their direction is subject to technical patterns.

After correcting to the price range of 91,000–95,000, Bitcoin will target the level of 88,500.

Historical data of BTCUSD suggests its correction do not tend to be rapid, unlike currency pairs’ correction. Before going back to 88,500, Bitcoin will be consolidating for two to three weeks, gathering its strength.

The rise in Bitcoin’s price in the last three days will attract a plenty of buyers, creating a buying overhang, which can only be met if closing prices are below current levels. While looking at the news feed, one can see a lot of sources calling the situation a return to the cycle of cryptocurrency growth. But as is usually the case in the market, excessive optimism is a condition for a fall followed by a repeat of the cycle.

Bitcoin needs to accumulate a lot of negativity and frustration to continue its upward move above the high of 109,000. The sentiments along with associated bearish stance will drive further growth. For now, emerging optimism of buyers is set to fuel a small corrective downward move.

The overall recommendation is to sell BTCUSD.

Profits should be taken at the level of 88,500. A Stop loss could be set at the level of 100,000.

The volume of the opened position should be set in such a way that the value of a possible loss, fixed with the help of a protective Stop loss order, is no more than 1% of your deposit funds.