On Wednesday, the AUDCAD currency pair continued trading in the consolidation phase near one-month highs. The Australian currency is supported by domestic macroeconomic data, as well as improved political situation in the world.

According to published statistics, the AiG Industry Index rose by 5.1 points in April to a seasonally adjusted -15. Although the index remains in the negative territory, it still reflects a slight improvement in the industrial sector. The AiG Manufacturing PMI similarly improved to -26.7 from -29.7 a month earlier.

Further boosting the Australian currency, US Treasury Secretary Scott Bessent and Trade Representative Jamieson Greer are set to meet Chinese Vice Premier He Lifeng in Geneva this weekend. These talks could mark the first step toward rebuilding US-China trade relations after the prolonged confrontation. This is particularly important for Australia as China remains its key trading partner.

Against this background, the Canadian dollar shows mixed dynamics. On the one hand, it received short-term support after the joint press conference of Canadian Prime Minister Mark Carney and American President Donald Trump, where the parties confirmed their intention to continue the dialog. However, weak domestic economic data are putting pressure on the loonie. The Ivey PMI unexpectedly dropped to 48.0 in April, indicating slowing business activity and intensifying doubts about the country’s economic recovery.

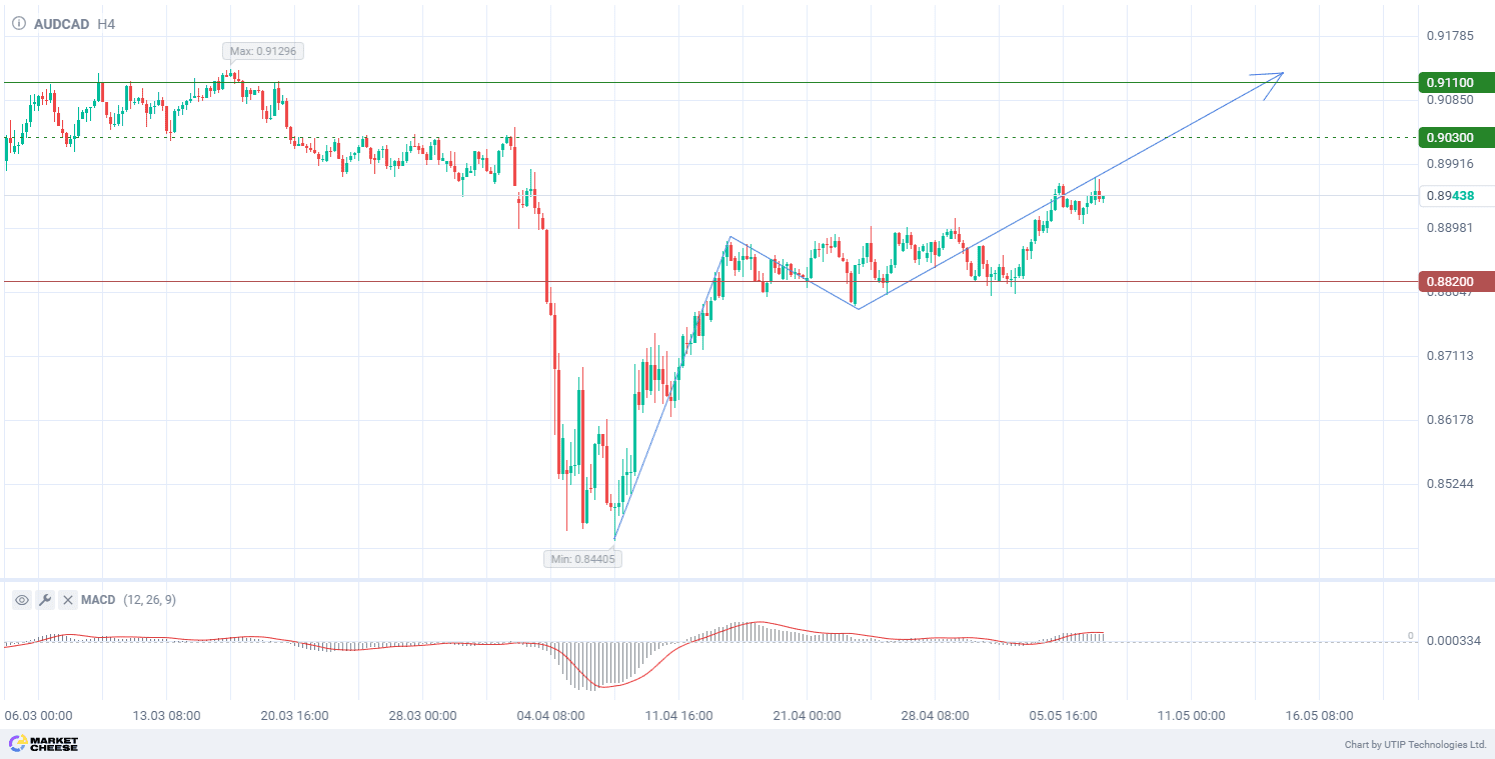

From a technical perspective, the AUDCAD pair is forming an ascending wave structure. In terms of wave analysis, the price is within the third ascending wave. Despite breaking through the first wave’s top at 0.8880, the current momentum remains subdued. However, the probability of global trade tensions easing may catalyze a stronger upside movement. The MACD (12, 26, 9) histogram holds above zero, confirming bullish pressure.

Signal:

The short-term outlook for AUDCAD suggests buying.

The target is at the level of 0.9110.

Part of the profit should be taken near the level of 0.9030.

A stop-loss could be placed at the level of 0.8820.

The bullish scenario is short-term, so a trading volume should not exceed 2% of your balance.