The USDCAD pair rose on Tuesday, though the gain was modest as investors reacted more calmly to Canada’s election results than expected and largely ignored falling oil prices. Wednesday’s opening price was 1.3829.

The US dollar remains under pressure from the Trump administration’s unpredictable trade policies, driving investors toward alternative assets. The White House’s attempts to scale back some tariffs are providing only limited support to the USD.

Meanwhile, the Canadian dollar is demonstrating resilience despite the election outcome and declining oil prices. Investors anticipate stabilized trade relations, particularly with the upcoming USMCA review in 2026.

On Tuesday, President Donald Trump signed executive orders designed to mitigate the impact of previously announced auto tariffs that could have severely disrupted US-Canada-Mexico trade flows. The new measures combine manufacturing incentives with duty exemptions for select components and materials, easing pressure on Canadian exporters. This supported the Canadian dollar (CAD), reflecting the auto sector’s crucial role in Canada’s exports.

US macroeconomic data presents a mixed picture: declining consumer sentiment and a widening trade deficit are creating headwinds for the USD. The upcoming US GDP release could intensify pressure on the dollar if it confirms the economic slowdown stemming from Washington’s trade policies. Meanwhile, Canadian GDP figures are also anticipated.

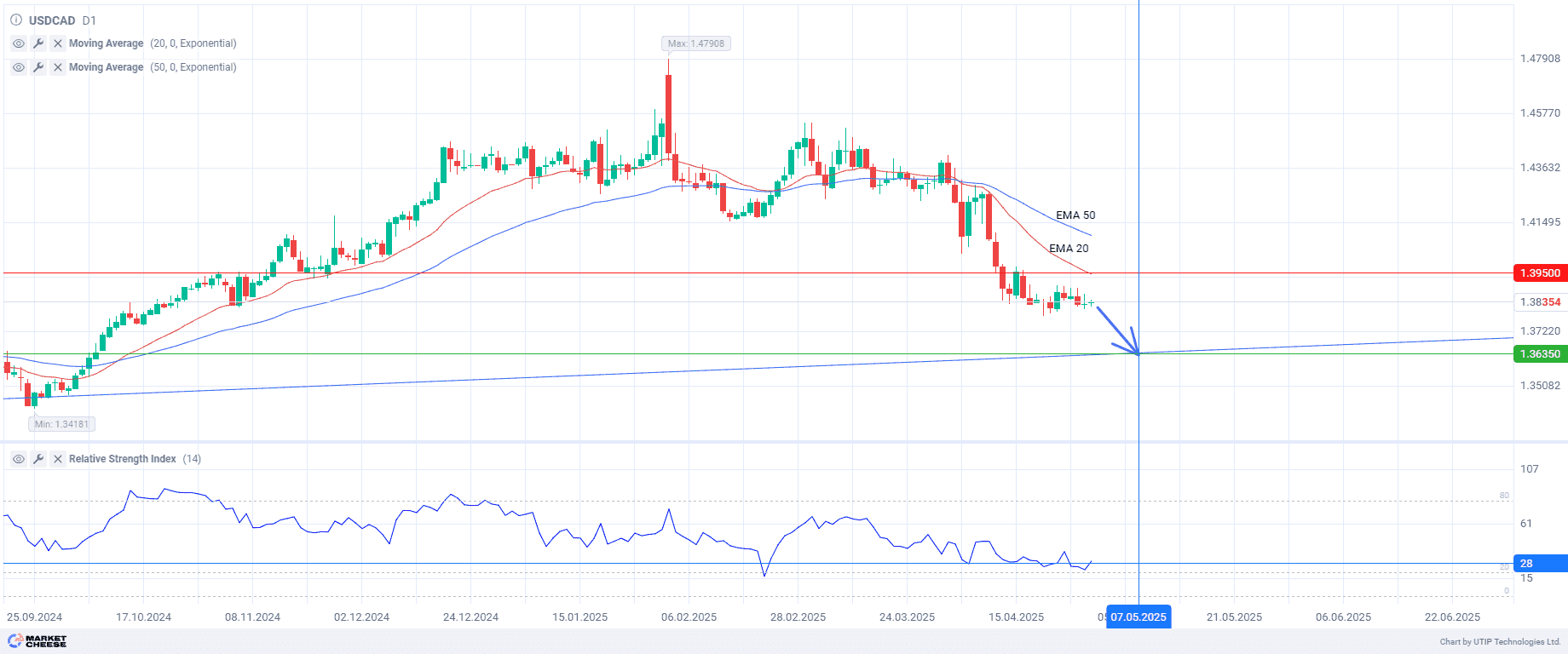

The technical picture confirms the ongoing downtrend. While the RSI approaches oversold territory, this doesn’t ensure a market correction. The 20-day EMA remains below the 50-day EMA, confirming seller dominance. Both moving averages are trending downward, reinforcing the likelihood of further declines.

It is recommended to prepare for potential corrections while maintaining a primary focus on selling opportunities.

Current recommendation:

Sell USDCAD at the current price. Take profit – 1.36350. Stop loss – 1.39500.