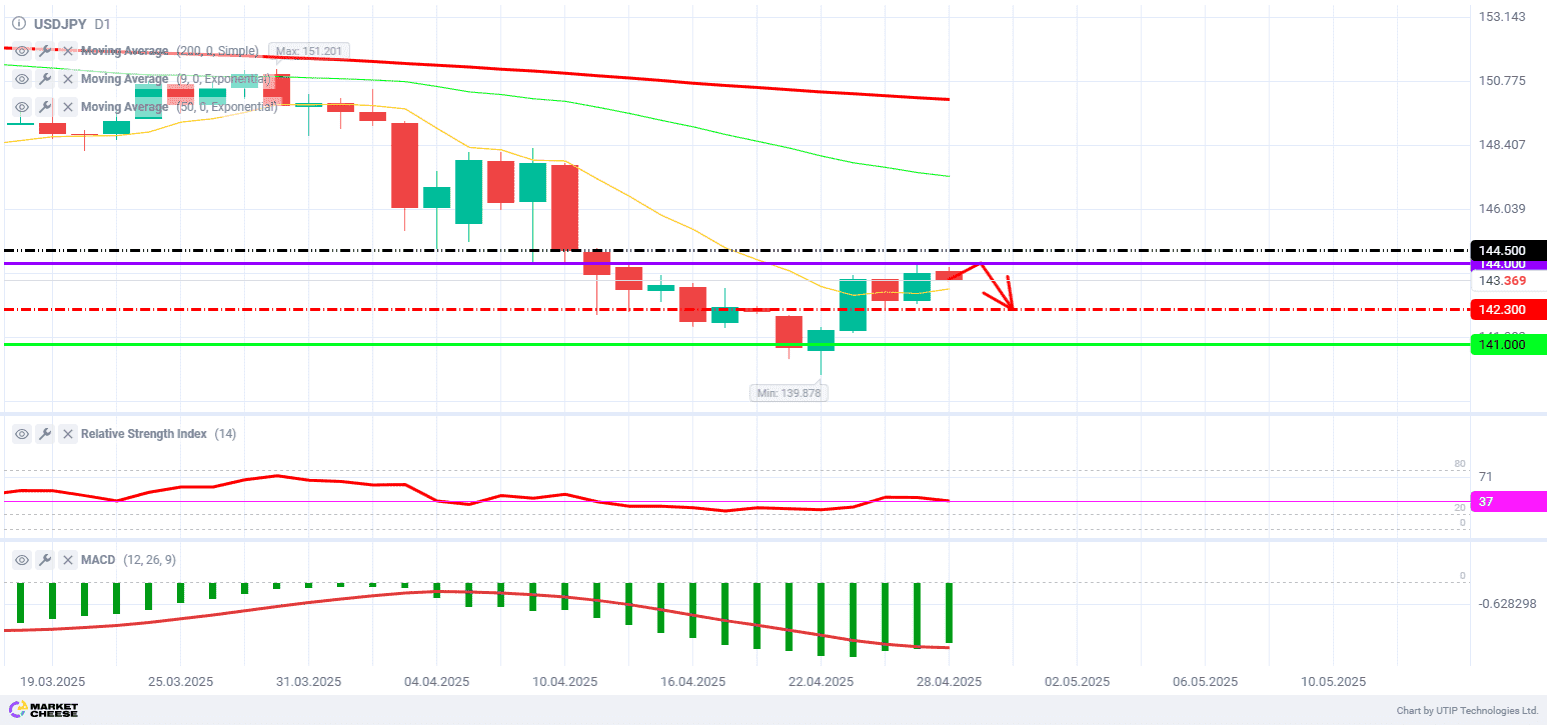

The USDJPY pair bounced off the 141.00 support level last Tuesday, April 22, and showed steady growth of 2,900 pips (+2.06%) by the end of last week. Today, April 28, the pair is trading at 143.50. The pair faces next resistance at 144.00, a level briefly tested by Friday’s daily candle high before rejection. While a retest and potential breakout remain possible this week, current price action suggests near-term pullback risk at this resistance zone.

The Relative Strength Index (RSI) on the daily timeframe is at 37, indicating the formation of a downtrend and weakening buying interest among market participants. The four-hour and hourly RSI readings stand at 56 and 53 respectively, showing downward movement from their recent highs and suggesting traders are turning to sell positions.

The Moving Average Convergence Divergence (MACD) indicator on the daily timeframe remains deep below the zero level, despite receiving an upward impulse during the currency pair’s growth last week. On the four-hour and hourly timeframes, the MACD has turned toward the zero mark.

Japan’s inflation has remained above the 2% target for three consecutive years. Major corporations continue to implement substantial wage increases this year. These developments provide the Bank of Japan with grounds to consider monetary policy tightening in 2025, supporting the yen’s potential for further appreciation.

As for the US dollar, traders are betting on the Federal Reserve restarting its rate-cutting cycle in June and lowering interest rates by a full percentage point by year-end. This should prevent the dollar from strengthening further after its rise last week from multi-year lows.

Trading Strategy: sell at the current price with Take Profit at 142.300 and Stop Loss at 144.500.